Kevin Riford

The Time I Purchased a Bail Bond That Turned Out to Be Fraudulent

My sister, Katie Riford, was arrested in Niagara County Family Court in May 2023. The judge set her bail at $100,000 — an amount that no ordinary person could realistically afford.

I began calling several bail bond companies across Western New York, from Erie County to Niagara County. Most of the bondsmen required collateral — like car titles — which was understandable, but unfortunately, I couldn’t provide any. Still, desperate to get my sister out of jail, I kept searching.

Just as I was about to give up, I came across a bondsman who worked for Upstate Bailbonds, based in Niagara Falls — the same county where my sister had been arrested. He told me something that immediately struck me as odd: that no misdemeanor charge should carry a $100,000 bail. He said he’d call the county to verify and get back to me.

Later, he called and said he could take $5,500 in cash and post the full $100,000 bond to get my sister out. Before moving forward, I searched Upstate Bailbonds on the New York State Department of Financial Services website to confirm they were a licensed company — and they were.

I asked the bondsman, Barima Yaw, to meet me inside the Niagara County Jail so I could hand him the money. He got noticeably nervous and said, “We don’t do that inside the jail,” indicating the transaction would need to happen elsewhere. I would receive a phone call from Barima Yaw while I was driving to the Niagara County jail, and he would indicate that my sister was already out of jail— before I even gave him the cash. My sister Christina and I both found that very strange, but since Katie was free, I felt obligated to hand over the $5,500.

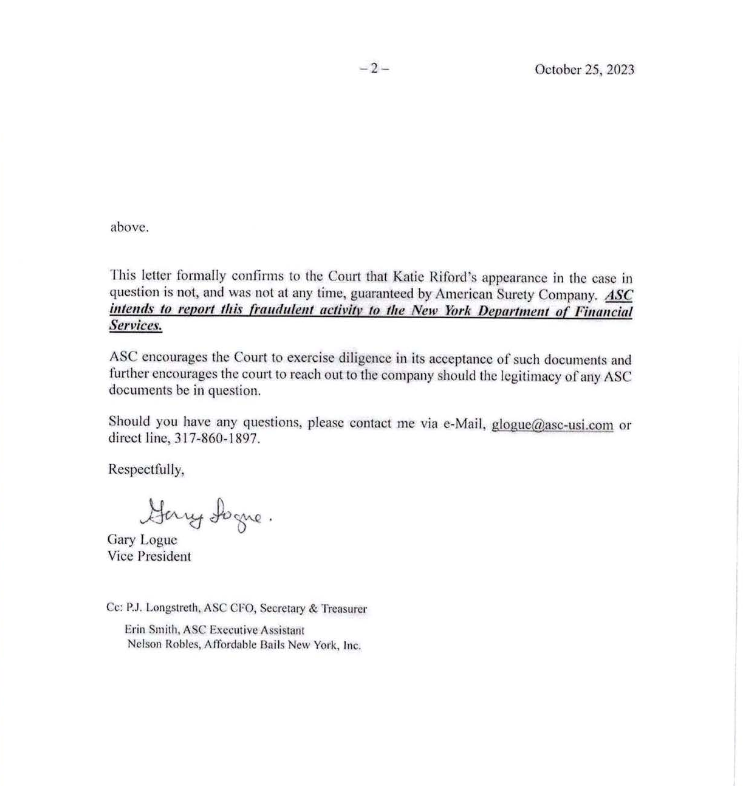

Later, my suspicions grew — especially when the court seemed reluctant to provide a copy of the actual bond. Eventually, we did get a copy, after much pushback. The surety company listed on the bond — which is not the same as the bail bondsman — became central to what we learned next.

(For context: when you buy a bail bond, the bondsman provides the bond, but it’s backed by a licensed surety company. That bond is then submitted to the court to secure the person’s release.)

Gary Lougue, the Vice President of the surety company, later emailed a letter to my sister confirming that the bond used was indeed fraudulent. When I tried to speak with him by phone, he sounded nervous and hung up on me multiple times. That raised even more questions. Why wouldn’t a legitimate surety company want to stop a bondsman from misusing their name and scamming families?

My sister Katie Riford, submitted a complaint with the New York State Department of Financial Services, reporting Upstate Bail bonds and Barima Yaw for issuing a fraudulent bond. But despite multiple follow-up calls, we have received little more than vague responses — always being told “it’s under investigation.”

Something clearly wasn’t right. My family was scammed out of $5,500 and yet the people responsible seem to be operating without consequence. Where’s my families $5,500? As of today 6/26/2025, my family has not received our $5,500 back. I suppose the cost of having all your charges dropped 3 years is $5,500 paid in cash.

I guess I will wait patiently for Governor Hochul to respond to my email [insert sarcasm here]

Feel free to sift through email communications between myself in the NYS Department of Financial Services.

Stay tuned for Part II – I will be releasing the entirety of my conversations with the bail bond company & more. Thanks for reading.

Donate

Donate